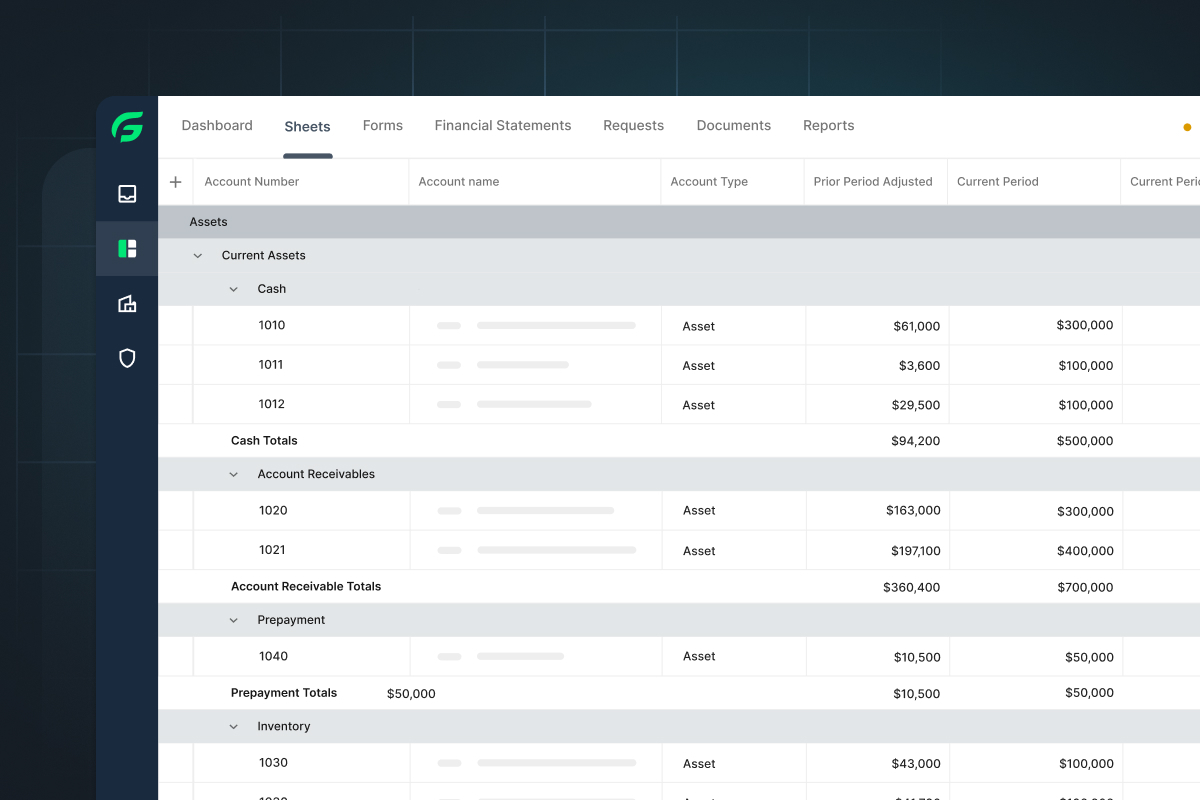

Fieldguide unites and automates the audit-to-tax workflow, eliminating handoff friction, and delivering a seamless client experience.

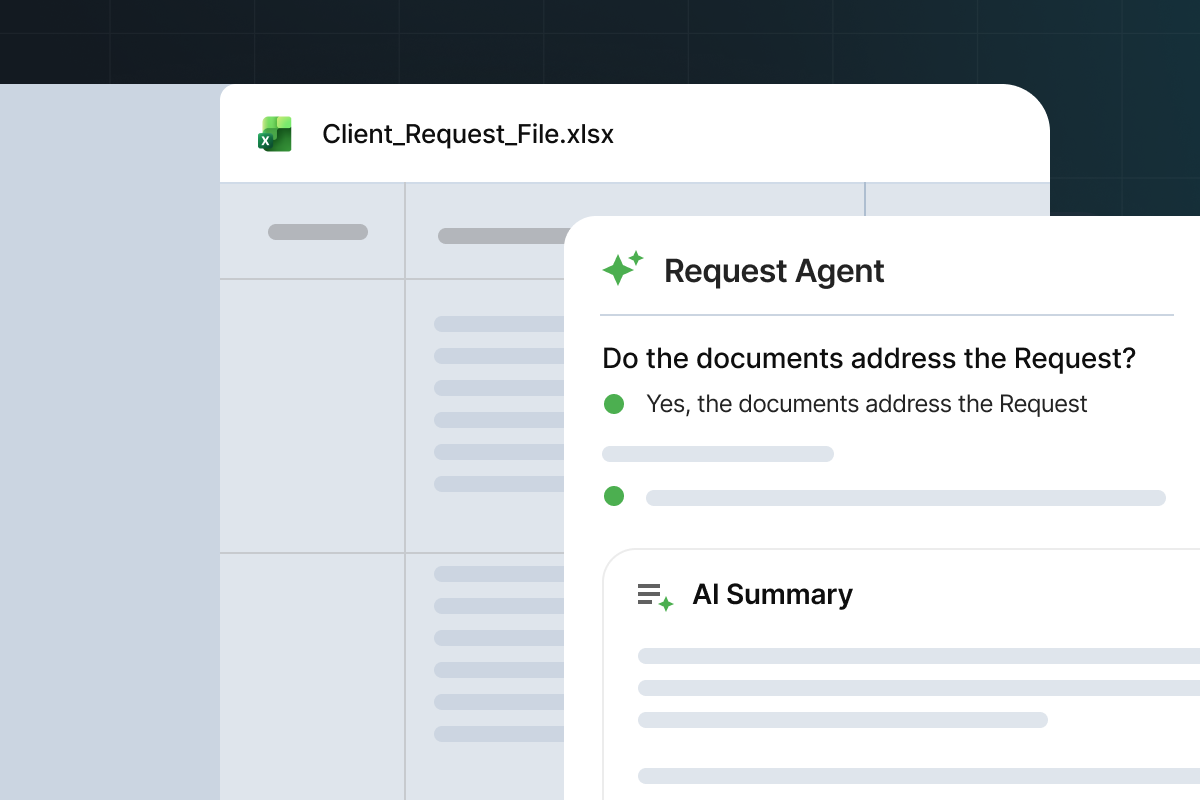

Incomplete PBCs and obsolete data are firms’ biggest source of frustration. Request Agent automatically analyzes client submissions, flagging mismatched or missing data, before they reach your team – saving weeks of manual work.

Teams waste time chasing data across binders and documents. Fieldguide’s embedded AI Chat gives instant, domain-specific guidance inside workpapers, helping you validate data, trace adjustments, and move forward quickly, with clarity and control.

When audit and tax share a single system, every document is protected and synchronized automatically. Version control, audit trails and enterprise-grade compliance come as standard. Clients feel the continuity; your teams feel the confidence.

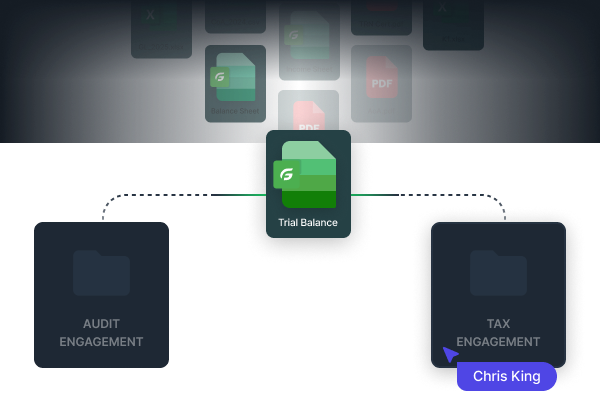

Fieldguide now unites audit and tax in a single intelligent workflow, streamlining collaboration and compounding firm capacity.

Smart engagement binders unite audit & tax teams with shared workflows, templates, document management, and Office 365/cloud PDF integrations.

Fieldguide links trial balances, mappings, and adjustments to protect version control and audit trails, ensuring data is always accurate, synchronized, and flows cleanly across service lines.

Request Analysis Agent checks documents for completeness and accuracy the moment they are uploaded. Clients know exactly what is missing and how to fix it before your team starts deep work.

Built directly into Fieldguide workpapers, AI Chat helps staff validate logic, trace data, and resolve questions instantly without breaking focus.

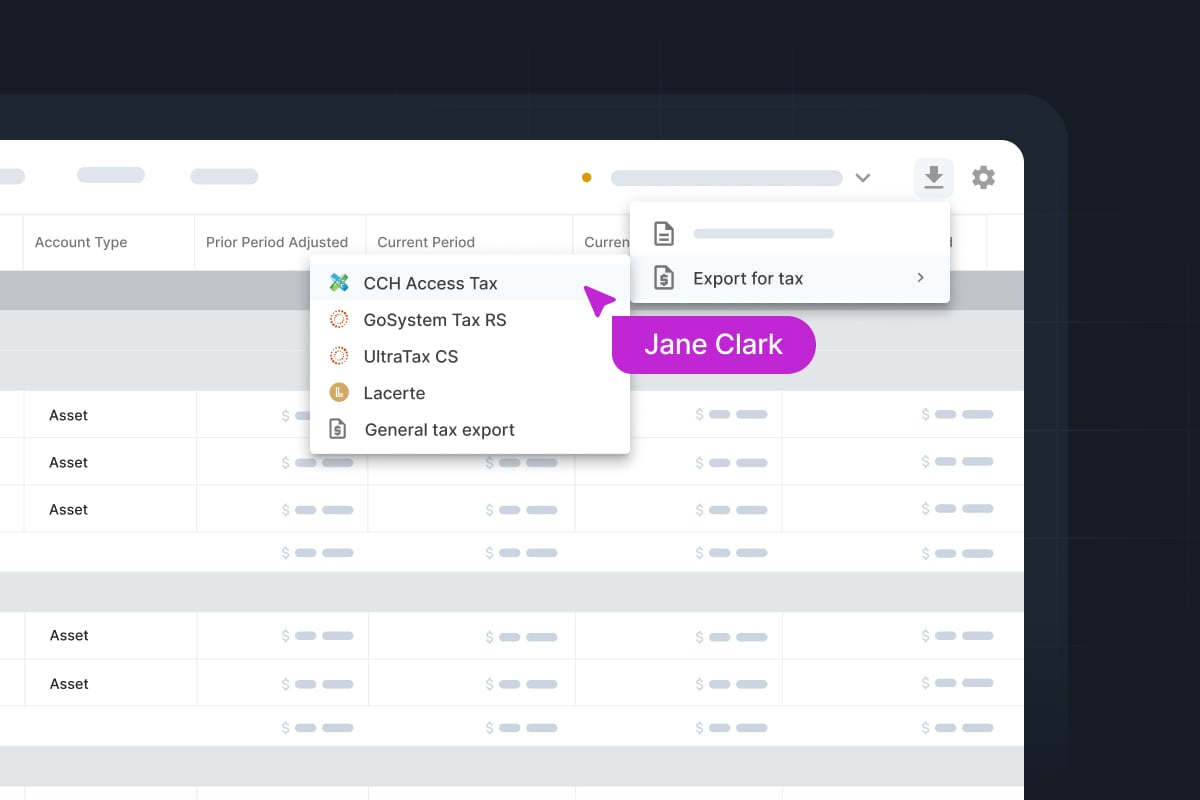

Fieldguide pushes critical data directly into ProSystem FX, UltraTax and CCH Axcess with precision and accuracy.